Enhancing The Investment Strategy by Equity Analysis

In today's fast-paced financial landscape, maneuvering through the world of investments can be a formidable challenge. With markets continuously fluctuating and new opportunities arising daily, making informed decisions is vital than ever. This is where equity analysis comes into play. By leveraging the expertise of equity analysis specialists, investors can gain valuable insights that enhance their investment strategies and ultimately lead to smoother sailing in the intricate waters of the stock market.

Equity analysis involves a comprehensive evaluation of a company's financial health, market position, and growth potential. This diligent process goes beyond just looking at numbers; it provides a well-rounded view of a company's prospects. Equity analysis specialists possess the skills and experience to sift through vast amounts of data, identify trends, and pinpoint key factors that can substantially impact investment outcomes. By working alongside these professionals, investors can position themselves to capitalize on opportunities and mitigate risks, thus sharpening their overall investment game.

Grasping Equity Evaluation

Equity analysis is a key component of investment strategy, centering on the assessment of a company's shares to ascertain its value and capacity for growth. Shareholders employ a range of metrics and methodologies to assess a company's economic condition, market standing, and earnings prospects. This evaluation allows individuals to make informed decisions about purchasing, holding, or divesting shares in a company.

The process typically entails both numerical and descriptive assessments. Quantitative analysis reviews financial reports, key metrics, and historical data to derive insights about performance and profit margins. Qualitative analysis examines beyond the figures, taking into account factors such as management excellence, industry patterns, and competitive edges. Together, these methods can provide a complete picture of a company's capability in the market.

Engaging with equity analysis specialists can enhance an investor's understanding and execution of these principles. These professionals bring expertise and sophisticated tools to analyze complex data and detect opportunities that may not be readily apparent. By leveraging their insights, investors can elevate their strategies and achieve better outcomes in their equity investments.

Key Metrics for Evaluation

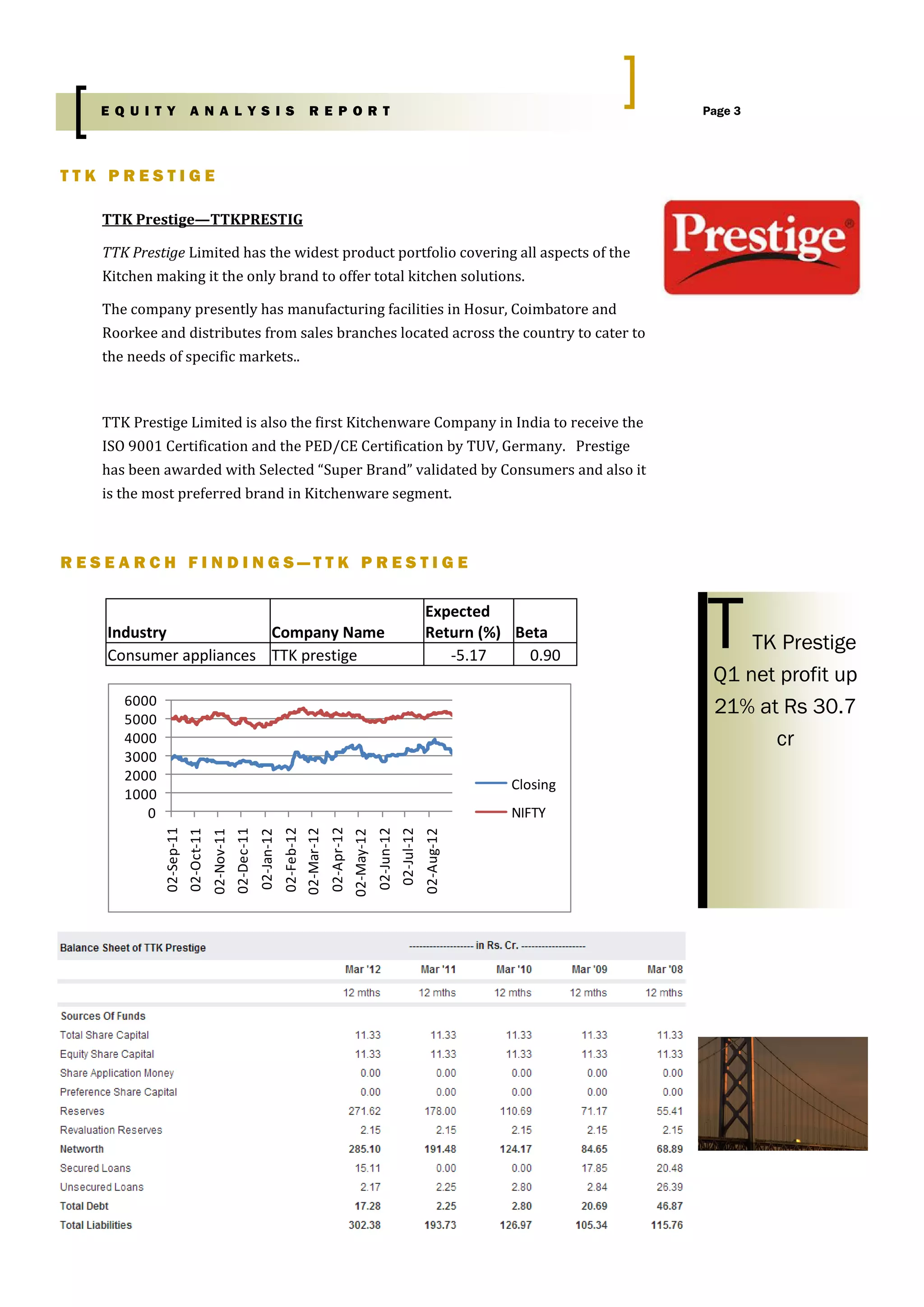

When executing equity analysis, understanding key economic metrics is crucial for making wise investment decisions. One of the primary indicators is the Price-to-Earnings (P/E) ratio, that compares a company’s current share price to its earnings per share. A significant P/E ratio may indicate that the market forecasts future growth, while a small ratio might suggest that the stock is undervalued or that the company is experiencing challenges. Analyzing the P/E ratio in the context of industry averages can provide deeper insights into a company's valuation.

Another significant metric is the Return on Equity (ROE), which measures a company's ability to generate profits relative to shareholders' equity. A strong ROE indicates effective management in utilizing equity financing to produce profits. It allows investors to gauge how well their investment is being used to yield earnings. Comparing ROE among peers can reveal which companies are doing better or worse within the similar sector, aiding in making comparative assessments.

In conclusion, the Debt-to-Equity (D/E) ratio is important for understanding a company’s financial leverage. This ratio contrasts a company's total liabilities to its shareholder equity, displaying the relative proportion of debt used to finance the company's assets. A high D/E ratio can indicate higher risk, especially in unstable markets, while a reduced ratio commonly suggests a more conservative approach to financing. Evaluating the D/E ratio alongside industry norms helps investors assess the risk profile of a company, enabling for better investment choices.

Developing an Investment Strategy

Establishing a robust investment strategy requires a detailed methodology that begins with comprehensive equity evaluation. Comprehending the essentials of the companies within your portfolio aids to identify which shares have high ability for appreciation. This requires examining fiscal reports, sales trends, profit statements, and economic trends. By utilizing the expertise of stock evaluation experts, individuals can gain subtle insights that might not be apparent from cursory analysis alone.

In addition to analyzing separate shares, it is important to take into account market trends and financial metrics that could impact aggregate performance. Stock analysis specialists are skilled at spotting patterns and establishing links between market mood and share valuations. By synthesizing this data, they can assist clients revise their plans in actual time, reducing hazards and capitalizing on new opportunities. This proactive method is critical for preserving a market edge in volatile conditions.

Lastly, setting specific financial objectives is key to creating an efficient strategy. Whether equity research report is to attain prolonged appreciation, produce revenue through payments, or diversify your holdings, an stock analysis expert can adapt suggestions to fit your monetary aspirations. By integrating personal objectives with expert insights, clients can create a balanced approach that aligns with both economic dynamics and individual needs, culminating to more knowledgeable and strategic investment choices.